Personal project

•ㅤㅤProblem Definition

ㅤㅤㅤㅤㅤName of this project

ㅤㅤㅤㅤㅤSansha - Saving & sharing e-wallets

ㅤㅤㅤㅤㅤExplaining: Sansha is an abbreviation combining the two words "save" & "share", meaning saving and sharing of finances among family members.

ㅤㅤㅤㅤㅤExplaining: Sansha is an abbreviation combining the two words "save" & "share", meaning saving and sharing of finances among family members.

ㅤㅤㅤㅤㅤProblem abstraction

ㅤㅤㅤㅤㅤPersonal financial management is simply understood as a job that helps manage money, arrange and plan spending, savings, and investments in a reasonable way.

ㅤㅤㅤㅤㅤSpending management plays a very important role in the life of each individual and each family, helping us to be more resilient to face challenges and major financial events in the future.

ㅤㅤㅤㅤㅤOur team's solution is to build a savings e-wallet application, combining financial management with groups, simple and easy to understand, supporting users to maintain planned savings and spending along with managing and monitoring the status of income and expenditure to balance their family finances.

ㅤㅤㅤㅤㅤSpending management plays a very important role in the life of each individual and each family, helping us to be more resilient to face challenges and major financial events in the future.

ㅤㅤㅤㅤㅤOur team's solution is to build a savings e-wallet application, combining financial management with groups, simple and easy to understand, supporting users to maintain planned savings and spending along with managing and monitoring the status of income and expenditure to balance their family finances.

•ㅤㅤDesign process

ㅤㅤㅤㅤㅤ1. Understand Context Of User

ㅤㅤㅤㅤㅤ- Identify the focus group of users.

ㅤㅤㅤㅤㅤ- Research context, market.

ㅤㅤㅤㅤㅤBuying habits and behavior of consumers, especially young Vietnamese.

ㅤㅤㅤㅤㅤThe lifestyle of young Vietnamese today.

ㅤㅤㅤㅤㅤMany young couples have problems with financial management, spending, and saving.

ㅤㅤㅤㅤㅤThe COVID-19 pandemic has shown the importance of saving and spending wisely.

ㅤㅤㅤㅤㅤ- Studying the operation method of online savings books at banking apps, savings apps, analyzing pros and cons.

ㅤㅤㅤㅤㅤ- Famous financial methods.

ㅤㅤㅤㅤㅤ- Interviewing and surveying users.

ㅤㅤㅤㅤㅤ- Research context, market.

ㅤㅤㅤㅤㅤBuying habits and behavior of consumers, especially young Vietnamese.

ㅤㅤㅤㅤㅤThe lifestyle of young Vietnamese today.

ㅤㅤㅤㅤㅤMany young couples have problems with financial management, spending, and saving.

ㅤㅤㅤㅤㅤThe COVID-19 pandemic has shown the importance of saving and spending wisely.

ㅤㅤㅤㅤㅤ- Studying the operation method of online savings books at banking apps, savings apps, analyzing pros and cons.

ㅤㅤㅤㅤㅤ- Famous financial methods.

ㅤㅤㅤㅤㅤ- Interviewing and surveying users.

ㅤㅤㅤㅤㅤ2. Specify User Requirements

ㅤㅤㅤㅤㅤ- Based on interviews & surveys, create user persona, empathy map.

ㅤㅤㅤㅤㅤ- Analyzing User Insight, User Story, User Journey.

ㅤㅤㅤㅤㅤ- Brainstorming to find out the main goals, needs of the users, requirements.

ㅤㅤㅤㅤㅤ- Analyzing User Insight, User Story, User Journey.

ㅤㅤㅤㅤㅤ- Brainstorming to find out the main goals, needs of the users, requirements.

ㅤㅤㅤㅤㅤ3. Design solutions

ㅤㅤㅤㅤㅤ- Building user flows that address these needs.

ㅤㅤㅤㅤㅤ- Wireframes, prototypes.

ㅤㅤㅤㅤㅤ- Build design system.

ㅤㅤㅤㅤㅤ- Finished design.

ㅤㅤㅤㅤㅤ- Wireframes, prototypes.

ㅤㅤㅤㅤㅤ- Build design system.

ㅤㅤㅤㅤㅤ- Finished design.

ㅤㅤㅤㅤㅤ4. Evaluate against requirements

ㅤㅤㅤㅤㅤ- Self-assessment of suitability, advantages and disadvantages

ㅤㅤㅤㅤㅤ- Usability testing, heuristic testing.

ㅤㅤㅤㅤㅤ- Evaluation of suitability, advantages and disadvantages based on testing.

ㅤㅤㅤㅤㅤ- Go back to step 1/2/3.

ㅤㅤㅤㅤㅤ- Finished design.

ㅤㅤㅤㅤㅤ- Usability testing, heuristic testing.

ㅤㅤㅤㅤㅤ- Evaluation of suitability, advantages and disadvantages based on testing.

ㅤㅤㅤㅤㅤ- Go back to step 1/2/3.

ㅤㅤㅤㅤㅤ- Finished design.

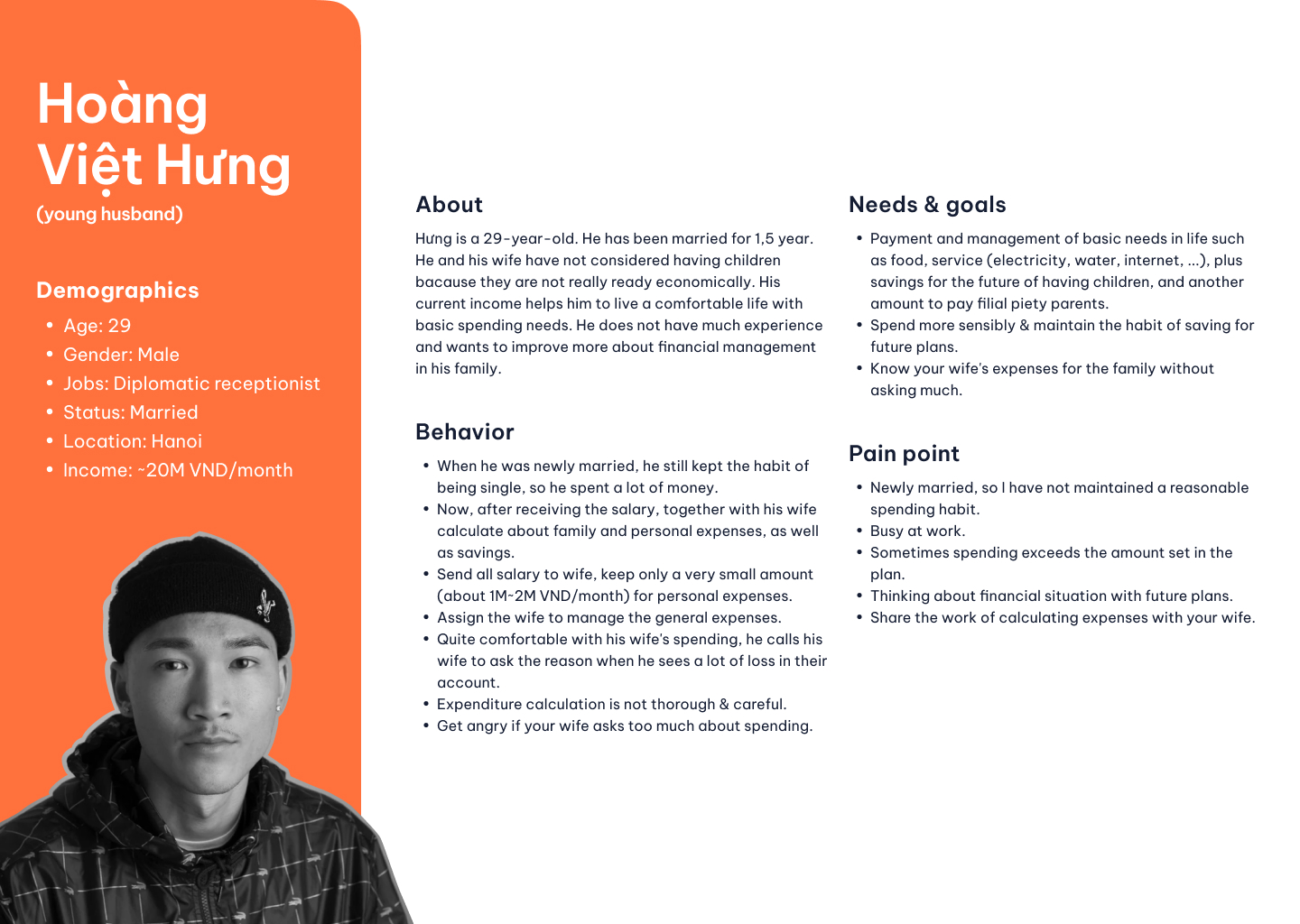

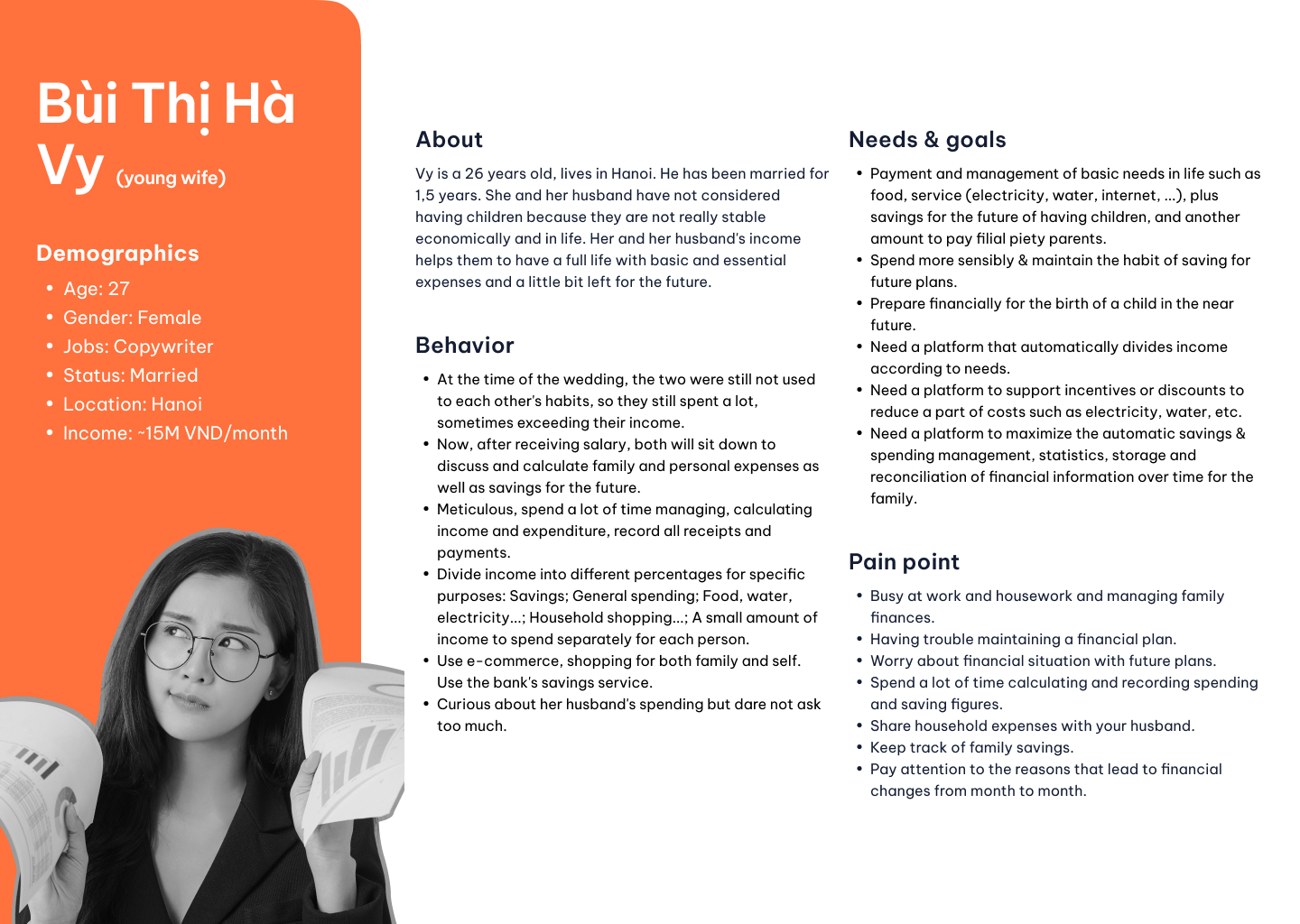

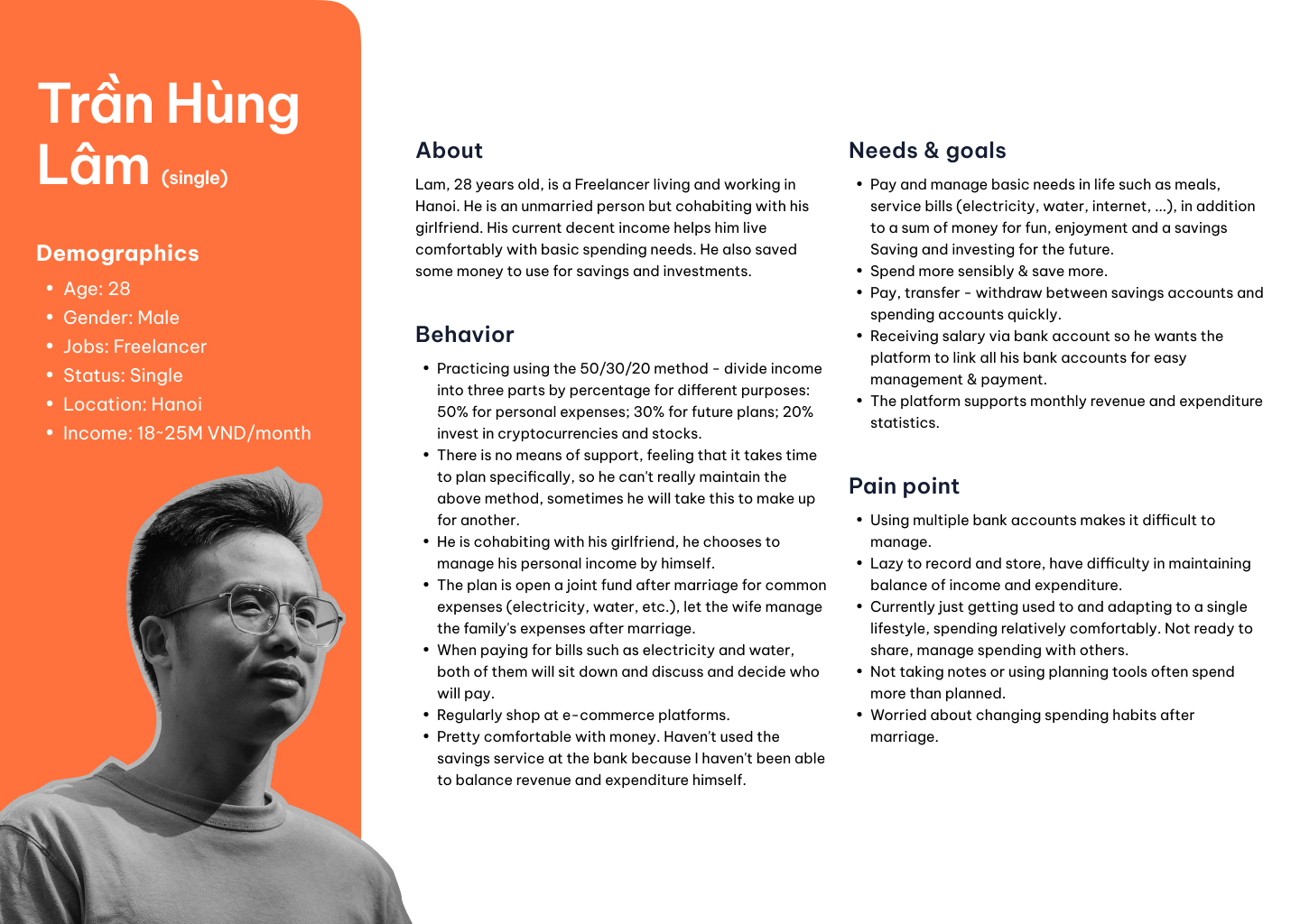

•ㅤㅤTarget users - User personas

ㅤㅤㅤㅤㅤConsists of 2 main groups

ㅤㅤㅤㅤㅤ- Young couples

ㅤㅤㅤㅤㅤㅤㅤㅤㅤㅤYoung husband

ㅤㅤㅤㅤㅤㅤㅤㅤㅤㅤYoung wife

ㅤㅤㅤㅤㅤ- Single

ㅤㅤㅤㅤㅤ- Young couples

ㅤㅤㅤㅤㅤㅤㅤㅤㅤㅤYoung husband

ㅤㅤㅤㅤㅤㅤㅤㅤㅤㅤYoung wife

ㅤㅤㅤㅤㅤ- Single

ㅤㅤㅤㅤㅤYoung husband

ㅤㅤㅤㅤㅤYoung wife

ㅤㅤㅤㅤㅤSingle

•ㅤㅤProblems statement

ㅤㅤㅤㅤㅤToday, many young Vietnamese have problems in planning, maintaining financial management and saving habits to achieve long-term financial security.

ㅤㅤㅤㅤㅤMany young newlyweds are not ready to share financial management together. In particular, the financial disclosure between the couple should be a top priority.

ㅤㅤㅤㅤㅤMany young newlyweds are not ready to share financial management together. In particular, the financial disclosure between the couple should be a top priority.

•ㅤㅤSolution statement

ㅤㅤㅤㅤㅤSaving and sharing e-wallet application for young users and newly married young couples (ages 22 to 34).

ㅤㅤㅤㅤㅤ- With the functions of payment, savings, financial planning and group financial management, the application will support users to pay, plan spending, saving, ensure balance and stability in maintaining that plan.

ㅤㅤㅤㅤㅤ- The application also helps family members to share financial management together.

ㅤㅤㅤㅤㅤ- The application also helps family members to share financial management together.

•ㅤㅤSpecify requirement

ㅤㅤㅤㅤㅤUser wants to pay.

ㅤㅤㅤㅤㅤ- Users want to link to multiple bank accounts they are using.

ㅤㅤㅤㅤㅤ- Users want to pay online.

ㅤㅤㅤㅤㅤ- Users want to receive more promotions.

ㅤㅤㅤㅤㅤ- Users want to withdraw cash, withdraw money to bank accounts, card accounts in case of necessity.

ㅤㅤㅤㅤㅤ- Users want to pay online.

ㅤㅤㅤㅤㅤ- Users want to receive more promotions.

ㅤㅤㅤㅤㅤ- Users want to withdraw cash, withdraw money to bank accounts, card accounts in case of necessity.

ㅤㅤㅤㅤㅤUsers want to manage finances.

ㅤㅤㅤㅤㅤ- Users who want to do financial planning.

ㅤㅤㅤㅤㅤUsers want to divide income into separate wallets according to different needs.

ㅤㅤㅤㅤㅤUsers want to manage family finances with their family.

ㅤㅤㅤㅤㅤ- Users want to saving.

ㅤㅤㅤㅤㅤUsers want to set up multiple savings accounts for multiple financial goals.

ㅤㅤㅤㅤㅤUsers want to save money with relatives and manage savings accounts.

ㅤㅤㅤㅤㅤ- Users want to store details of payments, send and receive money.

ㅤㅤㅤㅤㅤ- Users want to track and compare the status of revenue and expenditure, saving over time.

ㅤㅤㅤㅤㅤ- The user wants to change the financial plan.

ㅤㅤㅤㅤㅤUsers want to divide income into separate wallets according to different needs.

ㅤㅤㅤㅤㅤUsers want to manage family finances with their family.

ㅤㅤㅤㅤㅤ- Users want to saving.

ㅤㅤㅤㅤㅤUsers want to set up multiple savings accounts for multiple financial goals.

ㅤㅤㅤㅤㅤUsers want to save money with relatives and manage savings accounts.

ㅤㅤㅤㅤㅤ- Users want to store details of payments, send and receive money.

ㅤㅤㅤㅤㅤ- Users want to track and compare the status of revenue and expenditure, saving over time.

ㅤㅤㅤㅤㅤ- The user wants to change the financial plan.

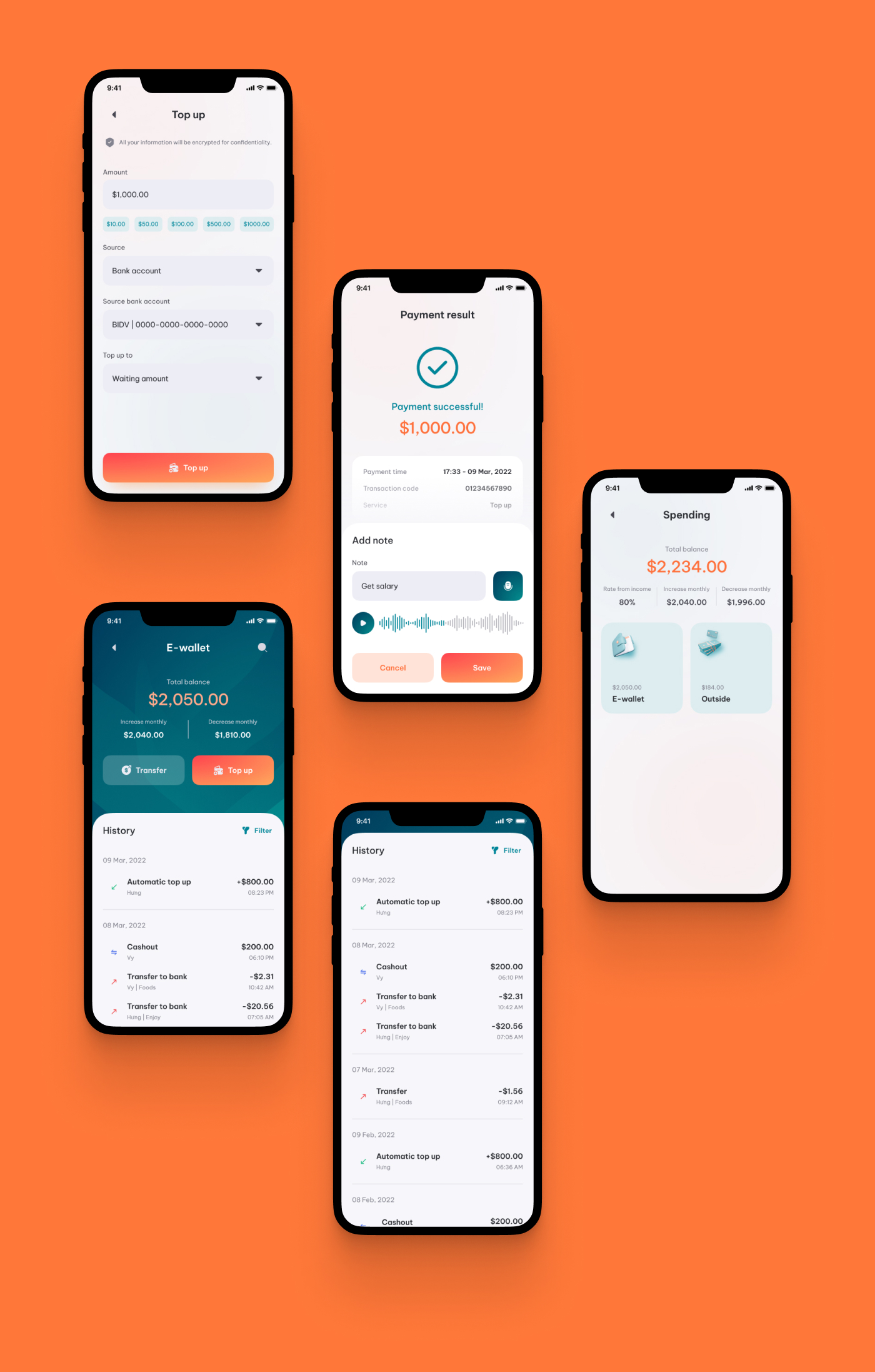

•ㅤㅤFunctions

ㅤㅤㅤㅤㅤE-wallet

ㅤㅤㅤㅤㅤ- Common functions of e-wallets include:

ㅤㅤㅤㅤㅤLink to multiple bank accounts.

ㅤㅤㅤㅤㅤPay online, pay by QR code.

ㅤㅤㅤㅤㅤOnline money transfer, money transfer by QR code.

ㅤㅤㅤㅤㅤDeposit money into the wallet.

ㅤㅤㅤㅤㅤWithdraw money to your bank account.

ㅤㅤㅤㅤㅤ...

ㅤㅤㅤㅤㅤ- Cash out with QR code

ㅤㅤㅤㅤㅤSimilarly, many banks now have QR cash withdrawal function. Users will go to the ATM and use the application, scan the QR code there easily and quickly.

ㅤㅤㅤㅤㅤ- Cooperate with service providers to create promotions.

ㅤㅤㅤㅤㅤ- The discount will be transferred to the savings account selected by the user.

ㅤㅤㅤㅤㅤLink to multiple bank accounts.

ㅤㅤㅤㅤㅤPay online, pay by QR code.

ㅤㅤㅤㅤㅤOnline money transfer, money transfer by QR code.

ㅤㅤㅤㅤㅤDeposit money into the wallet.

ㅤㅤㅤㅤㅤWithdraw money to your bank account.

ㅤㅤㅤㅤㅤ...

ㅤㅤㅤㅤㅤ- Cash out with QR code

ㅤㅤㅤㅤㅤSimilarly, many banks now have QR cash withdrawal function. Users will go to the ATM and use the application, scan the QR code there easily and quickly.

ㅤㅤㅤㅤㅤ- Cooperate with service providers to create promotions.

ㅤㅤㅤㅤㅤ- The discount will be transferred to the savings account selected by the user.

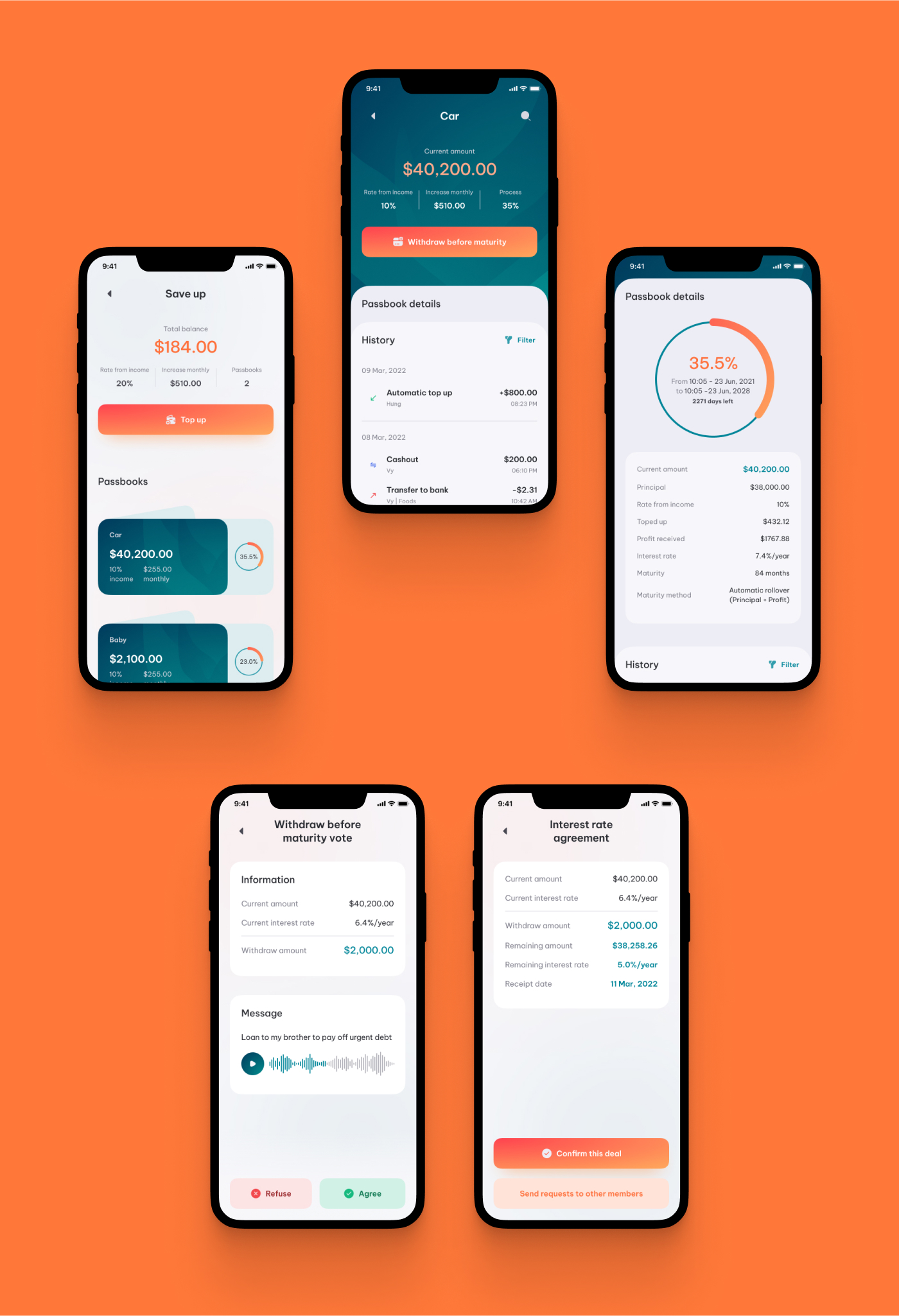

ㅤㅤㅤㅤㅤGroup financial management

ㅤㅤㅤㅤㅤ- Income division.

ㅤㅤㅤㅤㅤUsers create financial plans, divide them into separate spending and savings wallets depending on their needs. Recommend financial plans to users based on their goals.

ㅤㅤㅤㅤㅤ- Saving.

ㅤㅤㅤㅤㅤCreate multiple savings accounts. Users can create as many savings accounts as they need. Easily customize information, choose savings package, maturity method, deposit method.

ㅤㅤㅤㅤㅤAutomatically top up. Every time it's time for automatic top up, the system will automatically send a notification to the user, the user can choose to top up into the wallets according to the pre-set rate or customize other rate according to their preferences.

ㅤㅤㅤㅤㅤ- Group function - joint account.

ㅤㅤㅤㅤㅤAllows multiple users to use the same e-wallet, contribute to the same savings account, participate in financial management. Require the consent of all members when changing financial plans, withdrawing savings before maturity.

ㅤㅤㅤㅤㅤ- Store financial information (support by Speech To Text technology).

ㅤㅤㅤㅤㅤUsers can save payment, transfer, withdraw, and save information by pressing the “add note” button and reading the description. Description information will be saved to the system without having to spend time typing manually.

ㅤㅤㅤㅤㅤ- Financial tracking.

ㅤㅤㅤㅤㅤThe system of history, statistics compares the status of detailed savings over time for users to monitor and balance their financial plans.

ㅤㅤㅤㅤㅤ- Customize and change the established financial plan according to user needs.

ㅤㅤㅤㅤㅤUsers create financial plans, divide them into separate spending and savings wallets depending on their needs. Recommend financial plans to users based on their goals.

ㅤㅤㅤㅤㅤ- Saving.

ㅤㅤㅤㅤㅤCreate multiple savings accounts. Users can create as many savings accounts as they need. Easily customize information, choose savings package, maturity method, deposit method.

ㅤㅤㅤㅤㅤAutomatically top up. Every time it's time for automatic top up, the system will automatically send a notification to the user, the user can choose to top up into the wallets according to the pre-set rate or customize other rate according to their preferences.

ㅤㅤㅤㅤㅤ- Group function - joint account.

ㅤㅤㅤㅤㅤAllows multiple users to use the same e-wallet, contribute to the same savings account, participate in financial management. Require the consent of all members when changing financial plans, withdrawing savings before maturity.

ㅤㅤㅤㅤㅤ- Store financial information (support by Speech To Text technology).

ㅤㅤㅤㅤㅤUsers can save payment, transfer, withdraw, and save information by pressing the “add note” button and reading the description. Description information will be saved to the system without having to spend time typing manually.

ㅤㅤㅤㅤㅤ- Financial tracking.

ㅤㅤㅤㅤㅤThe system of history, statistics compares the status of detailed savings over time for users to monitor and balance their financial plans.

ㅤㅤㅤㅤㅤ- Customize and change the established financial plan according to user needs.

•ㅤㅤSome screens